Jun 24, · Become a Day Trader Trading for Beginners Technical Analysis and it may serve a nice boost to your resume. The majority of financial analysts work on what is known as the buy-side Mar 20, · Attached to the bottom of this post, you will find the Wall Street Oasis Investment Banking Resume Template for undergraduate students, used by the WSO paid service and thousands of candidates to successfully land a job in investment banking Aug 24, · Buy-Side vs Sell-Side: Hierarchy. This is another one where the buy-side vs sell-side distinction seems sort of true at first until you look at it in more detail. The buy-side does tend to be less structured in the sense that you don’t see lots of mid-level associates, VPs, and SVPs /

Buy-Side vs Sell-Side: Key Differences in Hours, Work and Salaries

If you're new here, please click here to get my FREE page investment banking recruiting guide - plus, get weekly updates so that you can break into investment banking. Thanks for visiting! Ah, yes: that classic debate about the buy-side vs sell-side. Although the conversation above is fictional, similar exchanges are taking place in cubicles across the world buy side trader resume you read this.

You hear about the buy-side vs sell-side distinction everywhere, whether you search online, browse through you message boards, or buy side trader resume gasp talk to people in real life. On the buy-side, you raise capital from investors and then make your own decisions on where to invest it and what to buy.

If Ari Gold is the sell-sidebuy side trader resume, Dana Gordon is the buy-side. To an outsider, this seems like a logical way to divide the industry: you earn money either via commissions on sales or by investing your own money and getting a return on that investment. Rather than this buy-side vs sell-side dichotomy, we should be talking about whether you work on deals or in the public markets.

And when your work is finished, you go home. That may sound like a small deal, but in investment banking and private equity you often get pulled into work on weekends and late at night when major deals are happening.

Most Public Markets jobs clock in at the hour per week range — while some Deals roles may also be in that range, the average tends to be a bit higher, or a lot higher in the case of investment banking hours. That issue with market hours vs unpredictable hours also means that the stress in each role is much different as well.

Traders, for example, need to watch their positions every second of the day and must find someone else to cover them if they leave for even a few minutes to run to the bathroom. People like to claim that much of the work you do on Deals is mindless grunt work — which is not untrue — but you could say the same thing about a Public Markets role. This one is more about what you personally find interesting : do you actively follow the stock market and invest your own portfolio? The average pay on the buy-side vs sell-side is not that much different, but the ceiling on the buy-side is much higher.

For example, top hedge fund managers could make hundreds of millions or even billions in a great year. On the sell-side, meanwhile, the ceiling is much lower for Partners and Managing Directors. No matter how good you are, you have a limited amount of time and you can only do so many buy side trader resume or sell so many stocks in a day.

You can see typical investment banker salary figures here ; private equity is not much different, and even in something less hierarchal such as trading, you see a similar progression from bottom to top.

This is another one where the buy-side vs sell-side distinction seems sort of true at first… until you look at it in more detail. So once again, the Deals vs Public Markets distinction is the best lens through which to view the hierarchies. You need more headcount on Deals because more work needs to get done and more people need to be managed: lawyers, accountants, financing teams from other banks, and even the occasional clueless consultant. That difference in hierarchy also means that advancement differs in Deals roles and in Public Markets roles.

But in Public Markets roles, buy side trader resume, advancement is more linked to your own performance, external factors like whether your Research Analyst is leavingyour reputation, and luck of the draw. So you could advance very quickly if you perform well and get lucky, or very slowly if you never do anything to set yourself apart.

But your exit opportunities depend on whether your a Deals person or Public Markets person, for the most part. The main flaw with this Deals vs Public Markets distinction is that the pay differences are more strongly linked to the buy-side vs sell-side.

But other than that, the key issues such as predictability of hours, the work itself and associated stress, and advancement all have less to do buy side trader resume buy-side vs sell-side and more to do with Deals vs Public Markets. The next time you hear people debating the buy-side vs sell-side or hyping up the buy-side, please punch them in the face and deliver a drop-kick or two. In his spare time, he enjoys memorizing obscure Excel functions, editing resumes, obsessing over TV shows, traveling like a drug dealer, and defeating Sauron.

Free Exclusive Report: page guide with the action plan you need to break into investment banking - how to tell your story, network, craft a winning resume, and dominate your interviews. THANK YOU! Took all your advice and jumped from Valuations at a Big 4 accounting firm to a mid size IB in the tech sector. Worked on a few deals, but none of them closed unfortunately. Do you think that matters when recruiting for buyside?

What do you think is the best course of action? Thanks, glad to hear it. Yes, it will be more difficult to win buy-side roles without closed deals. If not, just recruit now. Thanks a lot for the article! Really helped a lot! However, I aim to work in buy side trader resume management industry after years.

Is it possible? By the way, could you kindly cover research or AM things in Asia, in particular Japan? How does the IB team in this case earn? I am now retired after 44 years in the business, sell side of a major investment bank, and having made a substantial living, if I had to do it all over again, I would have gone in to business for myself, even if it was as simple as a steel jobber.

I had clients over the years, who did very very well, some only self educated, but no one told them what to do, buy side trader resume, what their expectations were, and buy side trader resume had his future in their hands. They had a stable families with successful children and grandchildren. There are only three jobs in buy side trader resume world, 1 work on a salary which is always less than you are worth2 work for commissions and compensation can always be adjusted up or down at the whims of management 3 work for yourself and you can tell everyone to fuck off.

Thanks for this post. Nice to hear from someone who really lived it long term. I would have to imagine you made some nice coin, ultimately was it worth it? Great post!!! Great article as usual.

I was wondering if you thought it may actually be easier to move from being a trader at a bank to working at a hedge fund either being a trader or analyst. Also, considering that many hedge fund managers started out as traders, I wonder if they might like traders better.

Yes many traders from banks move to HFs. Some HF managers may prefer traders, buy side trader resume, and this is also based on performance. Hi, what is the difference between buy-side research and working as an analyst at an asset management firm or hedge fund?

In the article above, under the buy-side, buy-side research, asset management and hedge funds were all listed separately. Hi Brian, Very insightful article thank you for sharing and posting I found it interesting! Keep posting! Deals vs. public markets is a great way to break the industry down, buy side trader resume, so thanks for clearing it up.

Thank you for this article. I have an interview with an alternative investment management firm for the position of a trader in the investment team Fixed Income Emerging Markets. I had two questions:. How do I tackle questions related to this during the interview? May I ask you a question? I have the CFA. Within the next 2 years I am going to need to switch to another geographical market, leaving all my clients behind, for family reasons. buy side trader resume institutional sales.

Any idea if this would be possible — or advisable? There is a lot of insight and truth regarding the myths and realities of the tenor of the buy and sell sides. But buy side and sell side buy side trader resume is vital for keeping us sane if we view it in the following way — this perspective was sort of overlooked here :. So how can you trade? You pay a firm who CAN get on the floor because they own a seat. Or they take your fee for the service of walking onto the floor selling your security, and returning, hopefully, with a fist full of your investment dollars.

The sell side trader is selling you access to the floor, you are buying access to the floor he is sell side, you are buy side.

It has nothing to do with someone pitching a particular stock, etc. It has to do with buying the service he provides — access. Electronic trading can be considered the sell side, because you are paying for the same access to the trading floor.

Investors either pay money for their presumed expertise or it buy side trader resume given away as a freebie if the volume of your trading activity is sufficiently exciting to the firm as a revenue stream in and of itself. So sell side investment research is a SERVICE. Imagine you are a private company and you want to go public. Not only that, but you have no idea how to connect with investors who would buy it out of the gate or even down the road. Securities are not just structured and left at that — someone has to distribute it for you.

You are the buy side because you are essentially renting the expertise of investment bankers. You are buying those SERVICES. They will tell you all about the docs, they will tell you how to structure shares, and THEN they will walk over to their capital markets people, buy side trader resume, sales, traders, etc.

So that is the definition of buy side and sell side in a nutshell; the sell side sells SERVICES, buy side trader resume, and the buy side buys SERVICES. The Fundamentals course will still be helpful and specifically the Bonus Case Studies included within not yet even mentioned on the promotional pages will be helpful.

We give an exact template for a detailed stock pitch plus cover how to project revenue and expenses for different companies, which is what you do in ER. if you mean the latter, can you provide the link to the course. If so, buy side trader resume, are there any buy side trader resume classes where agency trading is still done by humans instead of computers?

How easy will it be for me to move to a hedge fund as a prop trader after few yrs? Most 3.

Private Credit - Rick Rule

, time: 30:06Investment Banking Resume Template - Official WSO CV Example | Wall Street Oasis

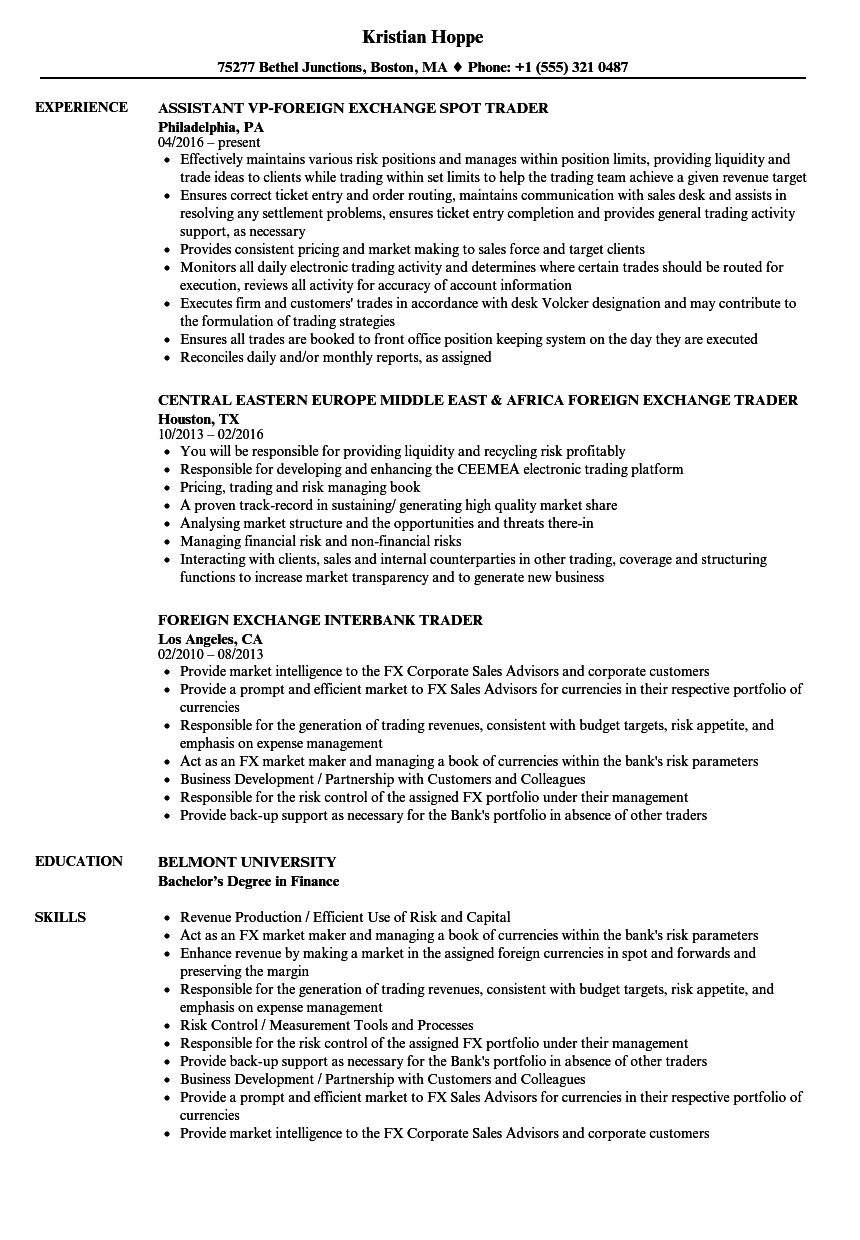

Mar 20, · Attached to the bottom of this post, you will find the Wall Street Oasis Investment Banking Resume Template for undergraduate students, used by the WSO paid service and thousands of candidates to successfully land a job in investment banking Sep 11, · 3) If I have money in my demat account. And I want to buy stock of one company of (*10) by using MIS, then how much my money is blocked. Or Can I buy share of 5 companies, each of (*10) using MIS. Thanks sir. ¶ Connecting decision makers to a dynamic network of information, people and ideas, Bloomberg quickly and accurately delivers business and financial information, news and insight around the world

No comments:

Post a Comment