H1: The compensation of a CEO is positively related to firm performance. The other part of this paper will try to determine relationship between the number of Board of directors in these companies and pays given to the CEO. As mentioned earlier, one of the key functions of the Board is to set the compensation of the chief executive officer Feb 01, · In , the average CEO of an S&P firm earned $ million. By , average pay for these CEOs had increased more than percent, to more than $14 million. When compared to the pay of average workers, the increase is even more dramatic: In , CEOs were paid 82 times the average of blue-collar workers; in , they were paid more than times those salaries Term Paper on CEO's Salary, Bonus, and Long-Term Assignment Complete the final report by [Date, Month] Limitations: The major limitation that is most likely to hinder the effective exploration or rather the exhaustive investigation of the topic is the time constraint that

Reining in CEO compensation and curbing the rise of inequality | Economic Policy Institute

Report Wages, Incomes, and Wealth, ceo pay research paper. Download PDF. Press release. What this report finds: Since the s, rapidly accelerating CEO pay has exacerbated inequality in the United States: High CEO pay generates pay increases for other high-level managers, while pay at the middle and bottom of the wage distribution continues to be depressed. While corporate boards technically report to shareholders, shareholders are not particularly well positioned to put pressure on directors to restrain CEO pay.

Why it matters: CEO pay is not just a symbolic issue. High CEO pay spills over into the rest of the economy and helps pull up pay for privileged managers in the corporate and even nonprofit spheres.

Importantly, the most direct damage done by excess CEO pay is to shareholders. Since shareholders are a relatively privileged group themselves if not as privileged as CEOsthey could potentially wield power in this situation; policymakers should try to figure out how to enlist shareholders in the fight to restrain excess managerial pay.

What can be done about it: Policies should be passed that boost both the incentive for and the ability of shareholders to exercise greater control over excess CEO pay, ceo pay research paper.

Tax policy that penalizes corporations for excess CEO-to-worker pay ratios can boost incentives for shareholders to restrain excess pay.

To boost the power of shareholders, fundamental changes to corporate governance have to be made. One key example of such a fundamental change would be ceo pay research paper provide worker representation on corporate boards. Finally, as a starting point, the Securities and Exchange Commission SEC should change the reporting requirements for corporations calculating their CEO-to-worker pay ratios to make them consistent over time and across firms; this will make these ratios far more useful to policymakers and the public.

There are many facets to the rise in American income inequality over the last four decades, but a particularly salient one is the explosion of pay for top corporate executives. While chief executive officers CEOs have always been well paid, the ratio of CEO pay to typical worker pay went from or to-1 in the s and s to or to-1 in recent years. This paper argues for the desirability of reining in CEO pay and discusses policy strategies that could be part of such an effort.

Its key findings are described below. Excessive CEO pay exacerbates inequality, ceo pay research paper. This excessive CEO pay matters for inequality, not only because it means a large amount of money is going to a very small group of individuals, but also because it affects pay structures throughout the corporation and the economy as a whole. Many directors of well-funded nonprofit institutions or colleges and universities, for example, once worked in the corporate sector and have seen their pay rise as corporate director pay rises.

Increasing CEO pay is not linked to increasing CEO productivity. The explosion of pay for CEOs of large firms is not strongly associated with evidence that these CEOs have become far more productive in their ability to generate returns to shareholders.

Weak corporate governance is a large part of the problem, ceo pay research paper. Research has demonstrated that CEOs are rewarded for luck and that weak corporate governance—boards of directors more concerned with hanging onto their own positions than with advocating for the best interests of shareholders—fails to restrain CEO pay by subjecting it to serious competition. Shareholders are not well positioned to hold corporate boards accountable. Reforming corporate governance to empower ceo pay research paper to rein in CEO pay will require policy changes that overcome a host of bad incentives and agency problems that currently keep boards of directors from working on behalf of shareholders.

Essentially, the market for good corporate governance is plagued by externalities—costs or benefits faced by actors not directly involved in the corporate governance decisions.

For example, because a large share of the benefits stemming from activist shareholders spending resources to try to discipline CEO pay will accrue not to the activists, but instead to the lazier group of shareholders who ceo pay research paper not spend resources in this effort, the gains from activism are substantially muted.

Similarly, the excess pay for CEOs at firms with particularly poor corporate governance puts upward pressure on pay for CEOs at firms whose shareholders do spend resources on good corporate governance, thereby reducing the payoff to these efforts, ceo pay research paper. Tax penalties or incentives ceo pay research paper be helpful in restraining CEO pay, if complemented with corporate governance reforms. A number of proposals for reining in CEO pay through tax penalties or incentives have been introduced in recent years.

These proposals have merit, but they would need to be complemented with corporate governance reforms to be effective in restraining CEO pay growth. We first outline the problem of excessive CEO pay over four sections: The first section briefly ceo pay research paper the history of CEO pay over the last four decades.

The second section draws out the implications of excessive CEO pay for the overall wage structure. The third section discusses the corporate governance problem and explains how the current system effectively allows CEOs to have their pay determined by their friends.

The fourth section puts ceo pay research paper pay in the context of returns to shareholders. This section draws largely on the work of Mishel and Schiederwho have clearly documented the explosive growth in pay for CEOs at the largest firms in the economy.

Table 1 —reproduced from their report—shows growth in CEO pay measured two ways and growth in annual compensation for production and nonsupervisory workers, ceo pay research paper. Using their preferred measure of CEO pay, which calculates it based on stock options realized, Mishel and Schieder document a rise in the CEO-to-typical-worker pay ratio from to-1 in to to-1 in to ceo pay research paper in to to-1 in Because CEO pay is often pegged to the share value of companies, the bursting of the stock market bubble in led to the decline of the CEO-to-worker pay ratio to to-1 by The stock market decline brought on by the financial crisis depressed it further, to to Since then, however, CEO pay has recovered smartly—Mishel and Schieder project 2 that the CEO-to-worker pay ratio reached to-1 in firms ranked by sales.

Notes: Projected value for is based on the change in CEO pay as measured from June to June applied to the full-year value, ceo pay research paper.

Projections for compensation based on options granted and options realized are calculated separately. Often, the stratospheric rise of CEO pay in recent decades is defended as simply another symptom of a technology-induced rise in the wage premium for skilled workers that allegedly occurred over the same time. This argument is not convincing. For one, evidence backing claims that technology-induced shocks to relative demand are driving wage inequality in the bottom 99 percent of the wage distribution has been shown to be quite weak.

In short, the rise in large-firm CEO pay in recent decades has been extraordinary and seems impossible to explain with generic forces that have affected the rest of the economy. There really does seem to be something special and especially broken about the market for CEO pay. The issue of high CEO pay is not just a problem of the top executives at large companies getting paychecks in the tens of millions of dollars. Excessive pay at the top affects pay structures throughout an individual corporation and even throughout the economy.

But pay of the next four highest-paid executives at these same firms totaled roughly this much on average as well. This would free up a considerable amount of money that would most likely accrue to shareholders in the form of higher corporate profits. The high pay of CEOs in corporate America also affects pay structures elsewhere in the economy.

As in the corporate sector, ceo pay research paper, the high pay for a CEO at a nonprofit also affects the pay of other top officers. The high pay for those at the top comes to some extent at the expense of pay for those at the middle and bottom of the wage ladder, ceo pay research paper. High pay in the corporate sector also affects pay in government. While wages at the top of the government pay ladder are usually held down ceo pay research paper statute, people are often hired on contracts by which their effective pay may be many times higher than the pay of top government employees, ceo pay research paper.

The story would be quite different if high-level public officials could only expect to earn twice or perhaps three times their pay in the corporate sector, as opposed to 10 times or more. For these reasons, we would be looking at a very different world in terms of income inequality, regulatory quality, and corruption if we could get CEO pay back down to the levels, relative to ordinary workers, that we saw in the s and s.

The economy and corporate America performed very well through most of this period when CEO pay was not so outsized. It would be difficult to argue that top executives lacked incentives and that talented people did not consider running a major corporation to be worth their time in those years.

The main justification for why shareholders tolerate huge increases in CEO pay—money that comes directly out of their pockets—is that this higher pay is necessary to attract the CEOs ceo pay research paper produce good returns for shareholders. In that narrative, shareholders are getting a good deal even with these very high pay packages for CEOs. Before we turn to the evidence, it is important to be clear about what is at issue.

Corporations obviously need to have someone in charge although there is no reason it needs to be a single person, ceo pay research paper. In that sense, it is trivially true that CEOs contribute an enormous amount of value to shareholders in the sense that corporations contribute value to shareholders and CEOs lead these corporations.

But the issue is not how valuable having a CEO is to shareholders relative to having the company operate aimlessly, the question is how valuable a specific CEO is relative to the other people who could fill the position. If the people who are next in line, or who could be hired from other companies, are as capable as the current CEO, then the value of the CEO to the company is only as high as what they would have to pay to replace them.

We certainly apply this logic to the pay of other jobs. The reason ceo pay research paper are so low paid is that other people can be found to do the job for a very low wage; further, institutions unions or robust minimum wages, for example that could keep low-wage workers from having to accept low pay in order to secure work have been eroded over time.

For these reasons, it makes no sense to credit any CEO with all of the profits the company delivers to shareholders. There is considerable evidence that the pay of CEOs is not closely related to the returns they provide to shareholders.

For example, a study found that jumps in world oil prices led to large increases in the pay of CEOs at oil companies Bertrand and Mullainathan Presumably, the CEOs had nothing to do with the rise in world oil prices, so effectively they got large pay raises as a result of factors that were outside of their control.

The bulk ceo pay research paper CEO pay usually comes in the form of company stock or, more typically, stock options.

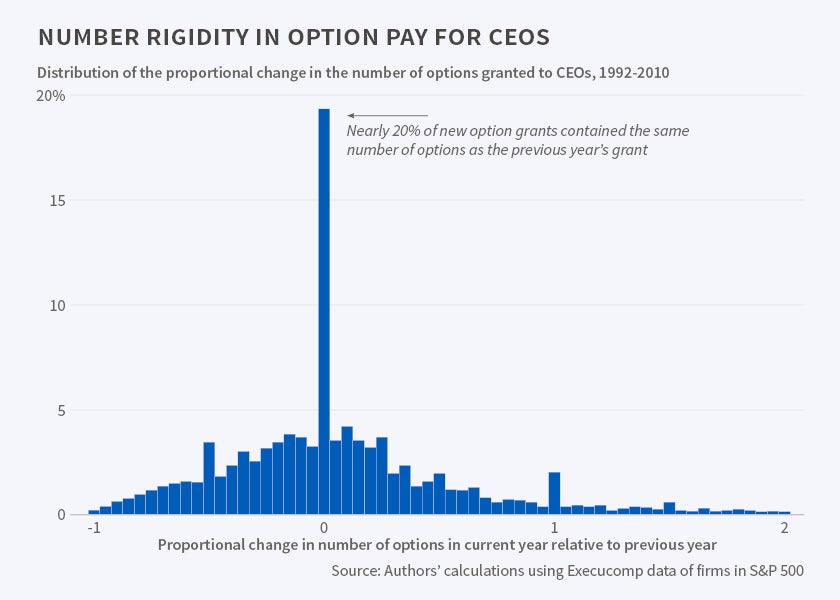

In principle, ceo pay research paper, company boards of directors could construct contracts ensuring that CEOs would only be rewarded for stock returns that exceed the average returns of companies in a reference group. While it is possible and even easy to structure compensation for CEOs in this way, these sorts of contracts are the exception. There is evidence that boards often have almost no understanding of the pay packages they grant to CEOs. A recent paper found that corporate boards largely failed to recognize that the value of an option was rising hugely over the course of the s as share prices soared due to the tech stock bubble Ceo pay research paper and Townsend This analysis found that most boards continued to issue the same number or a greater number of options to CEOs, even as the value of these options hugely increased, apparently because they did not want to seem to be cutting the pay of their CEOs.

Certainly directors cannot effectively rein in CEO pay if they do not even know how much they are paying them, ceo pay research paper. Quigley, Crossland, and Campbell looked at the impact of unexpected CEO deaths—such as in an airplane or car crash—on stock prices.

The reason for focusing on unexpected deaths is that it takes away the possibility that a death may have been anticipated and its impact already reflected in the stock price, as might be the case when a CEO dies after a long illness. In almost half of the cases examined since In fact, the market might be expected to overreact on the negative side to the unexpected death of a CEO, since there might be the expectation that the CEO actually was a major asset to the company even in cases where it is not true.

After all, why else would the shareholders have been paying them so much money? And yet there is little effect on share prices from these losses. Marshall and Lee looked at long-term year returns to shareholders relative to total CEO pay at large corporations over the years — The study found a significant negative relationship, with high CEO compensation associated with worse returns to shareholders, ceo pay research paper. The analysis divided CEO pay by quintiles and found that the total return to shareholders of companies with pay in the bottom quintile was more than 60 percent higher than the total return ceo pay research paper shareholders of companies with CEO pay in the top quintile.

These findings are hard to reconcile with claims that the pay of CEOs reflects their ability to increase returns to shareholders.

These and other ceo pay research paper indicate that there is little relationship between CEO pay and returns to shareholders. This would mean that it is reasonable to believe that shareholders could get away with paying their current CEO considerably less money and still get a comparable performance in terms of returns or, ceo pay research paper, alternatively, that they could hire another CEO who would do just as good a job for considerably lower pay.

There is one aspect to this picture that is underappreciated. It is often taken for granted that, while wage growth for the vast majority of American workers has been weak for decades, returns to shareholders have been strong. However, returns to shareholders have actually not been very good in recent decades.

Olin CEO compensation study

, time: 2:51When CEOs Are Paid for Bad Performance | Stanford Graduate School of Business

Why Has CEO Pay Increased So Much? Xavier Gabaix and Augustin Landier NBER Working Paper No. July JEL No. D2, D3, G34, J3 ABSTRACT This paper develops a simple equilibrium model of CEO pay. CEOs have different talents and are matched to firms in a competitive assignment model. In market equilibrium, a CEO’s pay changesCited by: H1: The compensation of a CEO is positively related to firm performance. The other part of this paper will try to determine relationship between the number of Board of directors in these companies and pays given to the CEO. As mentioned earlier, one of the key functions of the Board is to set the compensation of the chief executive officer Term Paper on CEO's Salary, Bonus, and Long-Term Assignment Complete the final report by [Date, Month] Limitations: The major limitation that is most likely to hinder the effective exploration or rather the exhaustive investigation of the topic is the time constraint that

No comments:

Post a Comment